What Do You Can Individual Sellers of Marijuana

- General Cannabis Command FAQ

- Sales and Licensing FAQ

- Local and County Cannabis Regulations FAQ

- Cannabis Revenue enhancement FAQ

- Cannabis Withholding FAQ

General Cannabis FAQ

Is it legal at present to buy or sell marijuana in Montana?

No, except that providers licensed under the Montana Medical Marijuana Program may sell marijuana and marijuana products to registered cardholders in the program.

An individual cardholder may possess up to ane ounce of marijuana (or the equivalent in concentrates or edibles), and may purchase upwardly to five ounces per month, but may not distribute it to other people.

Is developed-utilize marijuana possession and use legal in Montana?

As of January 1, 2021, adults 21 and over may possess and use up to 1 ounce of marijuana with no criminal penalties.

Notwithstanding, marijuana consumption and possession (including medical marijuana) remains prohibited in public and certain other locations. It is also prohibited under federal law on all federal lands and waters.

Marijuana (except medical marijuana) is prohibited in hospitals and other health care facilities.

Operating a motor vehicle under the influence of marijuana remains illegal.

Contact your local law enforcement bureau for more information.

When will developed-use sales begin in Montana?

Certain medical marijuana licensees will exist allowed to also sell adult-apply marijuana starting on January 1, 2022.

Is information technology legal for individuals in Montana to grow their own marijuana?

Adults may cultivate up to ii mature marijuana plants and two seedlings for private use in a individual residence, subject to certain restrictions. (Medical marijuana cardholders may cultivate up to four mature plants and four seedlings). The plants may not be visible to the public.

Is growing hemp permitted in Montana?

Yes. Hemp growers are licensed by the Montana Section of Agriculture.

Cannabis Sales and Licensing FAQ

Will adult-utilize marijuana be available for auction in all Montana counties on Jan 1, 2022?

No. In counties where the majority of voters supported Initiative 190 in November 2020, adult-apply sales may occur starting in January 2022. In counties where the majority of voters opposed Initiative 190, adult-utilise marijuana sales will remain prohibited.

What types of developed-apply marijuana licenses will exist available?

In add-on to continuing the Montana Medical Marijuana Programme, the Section of Revenue will issue separate licenses for marijuana cultivators, manufacturers, dispensaries, transporters, and testing laboratories.

The Department volition offer xiii different cultivation or "canopy" licenses for tillage facilities of different sizes.

A worker let will besides be required for any employee participating in any role of a marijuana business.

Can anyone use for a license to grow or sell recreational marijuana, or industry recreational marijuana products?

No. From January 1, 2022, until July i, 2023, but Montana medical marijuana licensees who were licensed on Nov 3, 2022 (or had an application pending with DPHHS on that engagement) may be issued a license for cultivation, manufacture, or sale of developed-use marijuana.

Will there be limits on the THC content in adult-use marijuana products?

Yes.

When licensees are able to operate, edible adult-use marijuana products may incorporate up to 10 mg of THC per serving, and up to 100 mg of THC in an entire bundle.

The full psychoactive THC of marijuana flower may not exceed 35%.

Topical products may contain no more than 6% THC and no more than 800 mg of THC per package.

A marijuana product sold as a capsule, transdermal patch or suppository, may contain more than 100 mg of THC, and no more than than 800 mg of THC in an entire parcel.

These limits practise non apply to sales by licensed medical marijuana providers to medical marijuana cardholders.

Will medical marijuana and recreational marijuana be available at the same business?

Aye. A licensed recreational marijuana provider and licensed medical marijuana dispensary may operate in a shared location. A unmarried entity may also exist licensed for both medical and recreational marijuana.

Are there adult-use marijuana licenses available for tribes?

Yes. The Department of Acquirement may issue a total of viii combined-utilise licenses (for cultivation and auction), 1 to each of the eight federally recognized Indian tribes located in Montana (or to a business that is bulk-owned by the tribe). Those licensees may operate within 150 air miles of the exterior boundaries of the reservation or tribal service area, if all other licensing conditions are met and they are located in a county that allows recreational marijuana licensees.

How can I become more than information on licensing for adult-utilize marijuana tillage, sales, transportation, manufacture, or laboratory testing?

The Section of Revenue is currently evaluating what rules and processes are necessary about these topics.

Subscribe to the section's newsletter to receive updates.

Volition marijuana licensees be permitted to sell their licenses the fashion alcohol licensees may sell their licenses to buyers approved past the Department?

No. The marijuana licenses may non be transferred.

Will a cannabis provider demand an Culling Nicotine or Vapor Products License?

Yous must take an Alternative Nicotine or Vapor Products Retail license if yous sell alternative nicotine or related products, including:

- Eastward-cigarettes

- Vapor Devices or Mods

- Accessories

- Liquid or e-juice

The license has a $20 almanac fee. You lot may apply for a new license or renew an existing license using the eStop Business Licenses Service.

You need an culling nicotine license even if you have a tobacco retailer license.

Who practise I contact for additional data virtually applying for or managing an Alternative Nicotine or Vapor Products Retail License?

If you have questions or concerns almost whatsoever Tobacco Product License or Culling Nicotine or Vapor Product License, delight phone call (406) 444-4351 or email [e-mail protected]

Local and County Cannabis Regulation FAQ

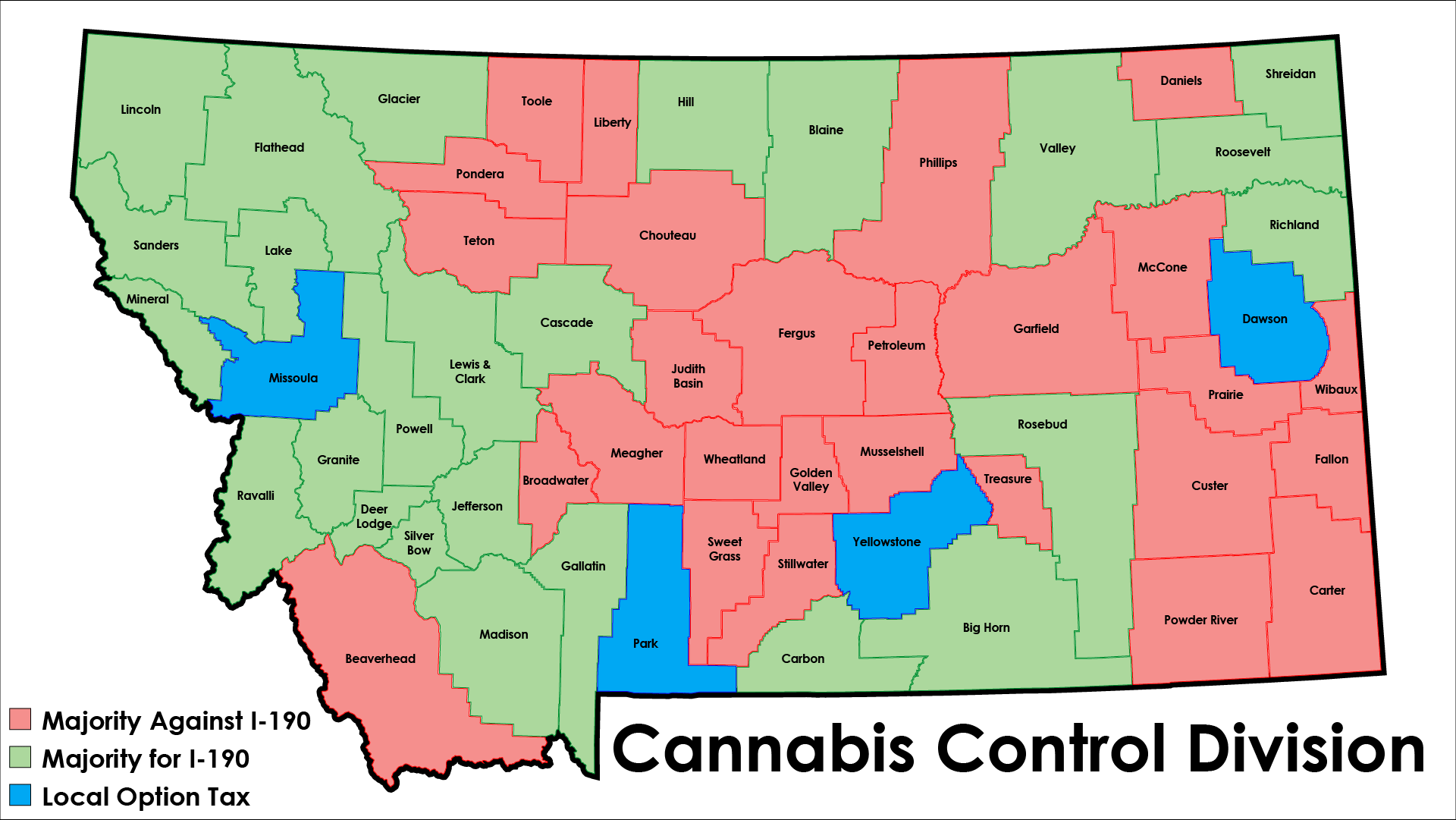

What counties approved Initiative 190, and which counties did not?

The counties currently assuasive recreational are outlined on the map. The current condition of each county was determined past the results of Initiative 190 or from a local election held since HB-701 was passed by the Montanan Legislature.

- Counties in red take no recreational adult-use cannabis sales.

- Counties in green allow recreational adult-sue cannabis sales.

- Counties in bluish have opted to include the local choice sales tax on cannabis sales.

For more information, please encounter Cannabis Tax.

Could a county change its position on marijuana businesses operating in its locality?

Yes. In a county where the majority of voters opposed Initiative 190, adult-utilise sales volition be immune if that county holds an ballot and a majority of the voters choose to let marijuana businesses to operate in that jurisdiction.

In a county where the majority of voters supported Initiative 190, certain marijuana businesses could be prohibited if that county holds a local election and a bulk of the voters cull to prohibit that type of business organization from operating.

When tin can a county expect their local option marijuana excise tax distribution?

Local option marijuana excise tax distributions will be fabricated 60 days later the quarter ending due date to ensure tax moneys take been fully received and reconciled.

| Period Catastrophe | Distribution Date |

|---|---|

| March 31 | June 15 |

| June 30 | September 15 |

| September 30 | December 15 |

| December 31 | March 15 |

Cannabis Tax FAQ

What will the revenue enhancement be on recreational marijuana?

Recreational marijuana will be taxed at 20% of retail sales.

Medical marijuana volition keep to be taxed at iv% of retail sales.

Local jurisdictions may add an additional revenue enhancement of upwards to iii%.

Can I claim a reduction on my cannabis tax render for using higher value products or superior production techniques?

No, the law does non provide for exemptions or reductions of cannabis tax for toll of appurtenances sold.

Will I be taxed on bad debt sales (sales deemed uncollectible)?

Yes. The cannabis tax is calculated on the marijuana provider's gross sales.

If I am a registered cardholder that cultivates my own product, am I subject field to cannabis taxation?

No, the dispensaries are the responsible party for collecting and remitting the tax. If y'all simply cultivate for personal utilise this is not taxable, beingness a licensed provider for additional cardholders is a taxable relationship.

What is included equally a "auction" for the cannabis tax? Exercise I pay the tax on products I requite away?

All gross sales of marijuana and marijuana infused products are taxable.

The tax is on the gross retail cost, which is the established price for which a marijuana product is sold to a purchaser before any discount or reduction.

"Auction" or "sell" means any transfer of marijuana products for consideration, exchange, castling, gift, offer for auction, or distribution in any manner or past any means. This includes marijuana and marijuana infused products.

Am I required to file a cannabis taxation return if I accept no sales for the quarter?

Yes. Y'all must still submit a revenue enhancement return through the TransAction Portal (TAP) for naught dollar returns.

What is taxed if I sell marijuana infused products? Can I dissever the ingredients on the receipt and only tax the value of the marijuana included in the production?

The entire gross auction amount for the marijuana-infused finish-product is subject to the tax.

Can I reduce the price for anile cannabis products?

Yes, if yous change your cost and that price is offered to all customers, that is the new established retail price.

The established retail price and any changes to that price should be documented and maintained in your records.

Can I offer a reduced price for bulk purchases of cannabis products?

Yes. If the new cost is offered to all customers, it becomes the new established cost.

If I offering product on credit, when is the tax reported?

Tax is due on the retail price of the products at the end of the quarter in which the production is received by the consumer.

How do I summate the tax on discounts to private cannabis customers?

The tax will be applied on the established retail price for the product. Discounts for a group or individual practice not change the established retail price.

Products priced below the established price for a select demographic is considered a reduction price, tax must exist applied to the established retail price.

As a Cannabis provider, do I need an Culling Nicotine or Vapor Products Retail License?

You must accept the Alternative Nicotine or Vapor Products Retail license if you sell alternative nicotine products, including:

- E-cigarettes

- Vapor devices or mods

- Accessories

- Liquid or e-juice

This license has a $20 almanac fee. You may utilize for a new license or renew an existing license using the eStop Business Licenses Service.

You demand an alternative nicotine license fifty-fifty if y'all have a tobacco retailer license.

If I have questions or need additional information almost applying or managing my Alternative Nicotine or Vapor Products Retail license, who practise I contact?

If you have questions or concerns about any Tobacco Product License or Alternative Nicotine or Vapor Product License, delight telephone call (406) 444-4351 or email [email protected]t.gov.

Cannabis Wage Withholding FAQ

As a cannabis provider, how exercise I register for a wage withholding account?

As a cannabis provider, do I need an Employer Identification Number (EIN) to result W-2s?

Yes, yous cannot issue W-2s to an employee using your Social Security Number (SSN). If yous practice non currently have an EIN, you tin can easily apply for one here.

Equally a cannabis provider, tin can I compensate my employee(s) with room and lath or whatever other type of non-greenbacks payments?

Equally defined in 39-51-201, Montana Lawmaking Annotated, "Wages means all remuneration payable for personal services, including the cash value of all remuneration payable in whatever medium other than cash. The reasonable cash value of remuneration payable in any medium other than cash must be estimated and determined pursuant to rules prescribed by the department." So, if yous pay with livestock, living quarters, material goods or other not-greenbacks payments, you must study their market value as wages on a form W-2.

As a cannabis provider, will I be considered and agronomical grower/employer?

No, cannabis is not recognized every bit an agricultural ingather in Montana.

As a cannabis provider, can I give my employees a 1099 NEC (Nonemployee Compensation) to written report wages earned?

No, employee wages and withholding must be reported on the federal grade West-two.

As a cannabis provider, when can I study compensation earned on a 1099 NEC?

Compensation reported on a 1099 NEC should only be given to those individuals or entities that are established and engaged in a business of their own. UI constabulary defines an independent contractor as "an individual working under an independent contractor exemption certificate provided for in 39-71-417, MCA". If you accept paid or contemplate paying someone every bit an independent contractor, the individual should accept an contained contractor exemption document. You should ask for a copy of that and retain information technology for your records.

Source: https://mtrevenue.gov/cannabis/faqs/

0 Response to "What Do You Can Individual Sellers of Marijuana"

Post a Comment